The "Hidden" Costs of Homeownership in Malaysia: Quit Rent, Parcel Rent, and Assessment Rates

When you buy a property in Malaysia, you may be surprised to learn that there are other costs involved besides the purchase price and monthly mortgage payments. These "hidden" or, perhaps more often, “overlooked” costs can add up over time, so it's important to be aware of them before purchasing a property.

The three most common "hidden" costs of homeownership in Malaysia are quit rent, parcel rent, and assessment rates. The taxes collected by the state government and local town councils are often calculated based on the value of your property.

Quit Rent

What is Quit Rent?

Quit rent, also known as Cukai Tanah, is a land tax imposed on property owners by local state governments in Malaysia via the country’s Land Office. It's a payment made in exchange for the right to occupy and utilize the land on which the property is built.

According to the National Land Code, all landed property owners, including both residential and commercial property owners, must pay quit rent to the respective state governments.

Quit rent is usually payable annually, once a year, and the due date varies from state to state in Malaysia, but most states have a cut-off date of 31 May.

Example of a quit rent bill:

How is Quit Rent Calculated?

Quit rent is a land tax imposed on owners of landed properties. It is calculated by multiplying the size of the property in square feet (sq ft) by the quit rent rate.

Here is the formula for calculating Quit Rent:

SQ.FT OF PROPERTY x QUIT RENT RATE = QUIT RENT AMOUNT

2,500 SQ.FT x RM 0.035 PSF = RM 87.50

It is important to note that the quit rent rate may vary depending on the property's location.

Parcel Rent

What is Parcel Rent?

Parcel Rent, also called Cukai Petak, serves a similar purpose to Quit Rent but applies specifically to owners of strata properties. Strata properties are properties that have been divided into smaller units, known as parcels, such as apartments, condominiums, or townhouses.

Interestingly, Parcel Rent was originally Quit Rent. In the past, a master quit rent for strata properties was charged to the property's joint management body (JMB). The JMB would charge the cost of the quit rent to the parcel owners through maintenance fees.

However, in June 2018, Parcel Rent was introduced by Selangor, followed by Penang in 2019, then Kuala Lumpur in 2020, where the tax is now charged directly to the parcel owners instead of the JMB. This change was made to make selling and transferring ownership of strata properties easier. Similar to Quit Rent, Parcel Rent is usually payable annually.

Example of a parcel rent bill:

How is Parcel Rent Calculated?

Parcel rent is calculated based on the size of the property. This is where Parcel Rent made a huge difference in costs compared to when it was Quit Rent.

Quit Rent for Strata Properties (Previous formula):

(SQ.FT OF PROPERTY x QUIT RENT RATE) / NO. OF PARCELS = QUIT RENT AMOUNT

(10,000 SQ.FT x RM 0.035 PSF) / 10 UNITS = RM 35

Parcel Rent for Strata Properties (Current formula):(SQ.FT OF PROPERTY x QUIT RENT RATE) = QUIT RENT AMOUNT

(10,000 SQ.FT x RM 0.035 PSF) = RM 350

For example, if the property of 10,000 sq.ft has 10 units, the ‘master’ quit rent will be charged to the JMB at RM 350, which will then be distributed to 10 parcel owners at RM 35 each in the form of maintenance fees. Meanwhile, Parcel Rent will be charged directly to all 10 parcel owners at RM 350 each.

Yes, that means the cost of homeownership has suddenly increased a lot for strata property owners under the current Parcel Rent compared to when it was still under Quit Rent previously.

Assessment Rates

What are Assessment Rates?

Assessment rate, also known as Cukai Pintu / Cukai Taksiran, is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services. This tax is essentially a charge to maintain the local area, such as:

Street lighting: This ensures that the streets are well-lit at night, making it safer for pedestrians and motorists.

Park maintenance: This includes tasks such as mowing the grass, trimming the trees, and removing litter.

Waste collection: This ensures that the garbage is collected regularly and disposed of properly.

Other miscellaneous tasks: This includes things like maintaining public toilets, cleaning drains, and repairing potholes.

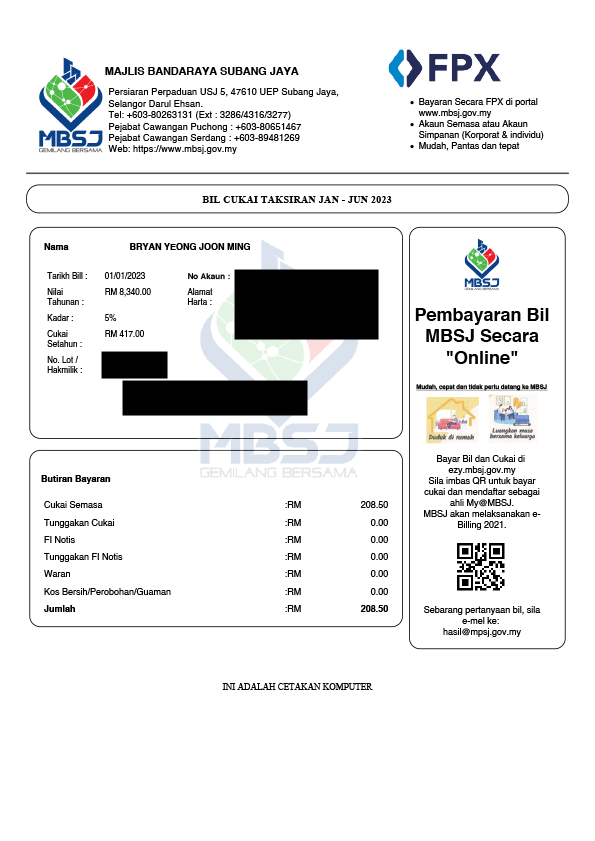

Example of an assessment rate bill:

All property owners in Malaysia must pay assessment rates, regardless of whether the property is residential, commercial, or industrial. This includes owners of bungalows, apartments, condominiums, factories, and other types of properties.

Even if you are renting out your property, you are still responsible for paying assessment rates. The tenant is not responsible for paying assessment rates.

Assessment rates are typically billed and payable annually, semi-annually, or quarterly, depending on the local authority's policies.

How are Assessment Rates Calculated?

Assessment rates are calculated based on your property's estimated annual rental value.

The estimated annual rental value is the amount your property would rent for if rented out on the open market. It is calculated by the local authority based on several factors, including the size of your property, the location of your property, and the type of property.

Once the estimated annual rental value is calculated, a set percentage rate is applied to determine the assessment rate you owe. The percentage rate differs from different states, but the general rate for Malaysia is 4% of the annual rental value of your property.

Here is the formula for calculating Assessment Rates:

ESTIMATED ANNUAL RENTAL VALUE (ESTIMATED MONTHLY RENTAL VALUE X 12) x PERCENTAGE RATE = ASSESSMENT RATES

(RM 2,500 x 12) x 4% = ASSESSMENT RATES

RM 30,000 x 4% = RM 1,200

For example, if your property's estimated annual rental value is RM30,000 (RM 2,500/month), you would owe RM 1,200 in the assessment rate. This is calculated by taking 4% of RM 30,000, the guideline percentage rate for landed properties in Malaysia.

Based on the sample above, assessment rates are collected over two payments across the year, which would be RM 600 per payment.

The payment schedule may vary by state, so it is essential to check with your local authority to determine your property's specific assessment rate requirements.

Can you choose not to pay Quit Rent, Parcel Rent, or Assessment Rates in Malaysia?

As much as we probably wish to “don’t know about it, hence, it does not exist”, failing to pay quit rent, parcel rent, or assessment rates in Malaysia is similar to avoiding income tax. It can have serious consequences, including:

A notice of arrears and a penalty charge.

Arrest and the confiscation of your belongings.

The seizure and auctioning off of your property.

The authorities have the power to track down and seize your property if you don't pay your land taxes.

How To Pay Quit Rent, Parcel Rent, Or Assessment Rates

There are several ways to pay your quit rent, parcel rent, and assessment rates in Malaysia, depending on your state.

Offline and in-person:

Land Registry Office: This is the most common way to pay land taxes. You can find the address of your local Land Registry Office's address on the Ministry of Finance Malaysia website.

Local district council: You can also pay your land taxes at your local district council office. Your local district council's address can be found on your state government's website.

Post offices: You can pay your land taxes at any post office in Malaysia.

Online:

Pos Online: Pos Malaysia offers an online payment service for land taxes. You can pay your land taxes using your credit card or debit card.

Online banking platforms: Most major banks in Malaysia offer online payment services for land taxes. You can pay your land taxes using your online banking account.

The Land Registry Office’s official online platform: Some Land Registry Offices have their own online payment platforms. You can find the link to the online payment platform on the website of your Land Registry Office.

Practical Tips for Property Owners

Managing and Budgeting: Incorporate these costs into your budget to ensure timely payments and avoid financial strain.

Government Agencies Contact Information: Keep a record of the relevant government agencies responsible for collecting these taxes. Stay informed about any changes in contact information or procedures.

Avoiding Late Payment Penalties: Set up reminders to ensure you meet payment deadlines and avoid unnecessary penalties.

In conclusion, being a responsible property owner involves more than just the initial investment – it entails managing ongoing costs and fulfilling legal obligations. By understanding and effectively managing quit rent, parcel rent, and assessment rates, property owners can contribute to their community's development and ensure a smooth homeownership experience.

Disclaimer: The following information is provided solely for general knowledge. DWG Malaysia Sdn Bhd assumes no responsibility or liability for the information's accuracy, adequacy, or reliability. This includes any warranties or representations regarding the suitability of the information for any specific purpose to the maximum extent allowed by law. While every reasonable effort has been made to ensure the information's accuracy, reliability, and completeness at the time of writing, it should not be solely relied upon for making financial, investment, real estate, or legal decisions. It is strongly recommended to seek advice from a qualified professional who can consider your individual circumstances and provide personalized guidance. DWG Malaysia Sdn Bhd disclaims all liability for any actions taken based on the information provided.